Buying a home is a big financial decision, and if you take a home loan, you can save on taxes. But what if you own more than one house? Can you still claim tax benefits? Let’s break it down in simple terms with examples.

1. Tax Benefits on Home Loan Repayment (Section 80C)

- You can claim a deduction of up to ₹1.5 lakh per year for the principal repayment of a home loan.

- This applies to any number of properties, but the total deduction cannot exceed ₹1.5 lakh, including other investments such as PPF, ELSS, etc.

Example:

- If you repay ₹1 lakh for House A and ₹1 lakh for House B, your total deduction under Section 80C will still be capped at ₹1.5 lakh.

2. Tax Benefits on Home Loan Interest (Section 24)

The rules differ based on whether the property is self-occupied or rented out.

A. If the Property is Self-Occupied

- You can treat up to two houses as self-occupied.

- For these, you can claim a maximum of ₹2 lakh per year as interest deduction.

Example:

- You have two self-occupied houses with interest payments of ₹1.5 lakh (House A) and ₹1 lakh (House B).

- Total interest = ₹2.5 lakh, but only ₹2 lakh is deductible.

B. If the Property is Rented Out (Let-Out Property)

- No limit on the number of properties.

- You must declare rental income and can claim full interest paid as a deduction.

- You also get a 30% standard deduction on rent (for maintenance, taxes, etc.).

Example:

- You earn ₹3 lakh in rent from a property.

- Interest paid on loan = ₹2.5 lakh.

- Taxable rent = Rent – (30% standard deduction + interest)

= ₹3,00,000 – (₹90,000 + ₹2,50,000)

= Loss of ₹40,000 (which can be adjusted against other income).

3. Loss from House Property & Carry Forward

- If your rental income is less than the interest paid, you incur a loss under “House Property.”

- You can set off up to ₹2 lakh of this loss against salary or business income in the same year.

- The remaining loss can be carried forward for 8 years and adjusted against future rental income.

Example:

- Rental income = ₹2 lakh

- Interest paid = ₹3 lakh

- Loss = ₹1 lakh (which can be adjusted against salary income).

- If the loss was ₹3 lakh, only ₹2 lakh can be adjusted in the current year, and ₹1 lakh can be carried forward.

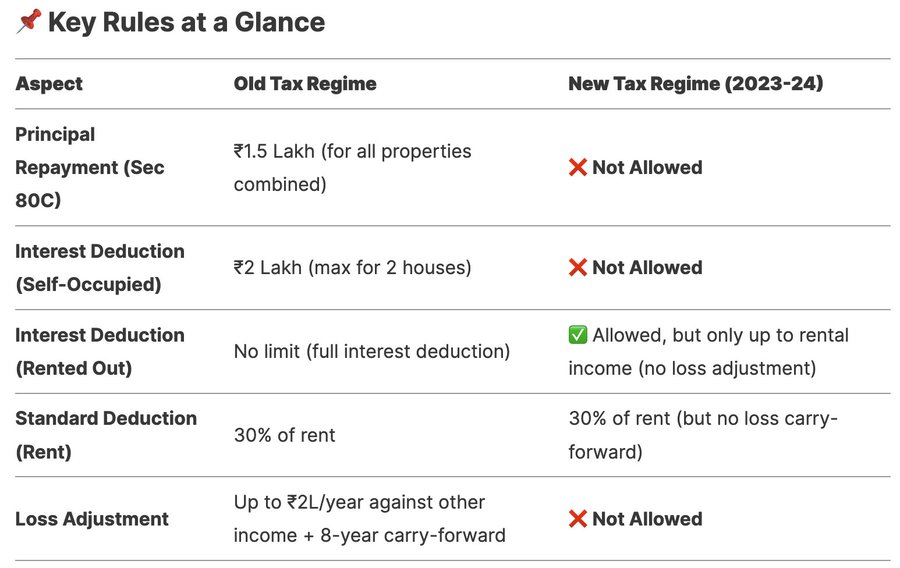

4. New Tax Regime vs. Old Tax Regime

- Old Tax Regime: You can claim both principal (Section 80C) and interest (Section 24) deductions.

- New Tax Regime (2023 onwards):

- – No deduction for home loan principal (Section 80C).

- – No deduction for interest on self-occupied property (Section 24).

- – For rented properties, you can claim interest only up to rental income (no loss adjustment).

Example (New Regime):

If you pay ₹3 lakh in interest but earn only ₹2 lakh in rent, only ₹2 lakh is deductible (no carry-forward loss).

Key Takeaways

- ✅Principal repayment (Section 80C): Max ₹1.5 lakh (for all properties combined).

- ✅Interest deduction (Section 24):

– Self-occupied: Max ₹2 lakh (for up to 2 houses).

– Rented out: Full interest deduction (no limit).

- ✅Loss adjustment: Up to ₹2 lakh per year; balance carried forward for 8 years.

- 🚫New tax regime: No benefits for home loans (except limited interest deduction on rented properties).

Final Tip

If you have multiple properties, plan wisely:

- Keep two as self-occupied (to claim ₹2 lakh interest benefit).

- Rent out the rest to claim full interest deductions.

Let’s dive deeper into how you can maximise your home loan tax benefits based on different scenarios, with clear calculations and actionable tips.

Scenario 1: Two Self-Occupied Houses (Old Tax Regime)

Conditions:

- You live in both properties.

- Maximum 2 houses can be declared as self-occupied.

Tax Benefits:

- Principal Repayment (Sec 80C): ₹1.5L (total for both loans).

- Interest Deduction (Sec 24): ₹2L (combined for both houses).

Example:

- House A: Principal = ₹1L | Interest = ₹1.8L

- House B: Principal = ₹1L | Interest = ₹1.5L

- Total Principal (80C): ₹2L → Only ₹1.5L deductible.

- Total Interest (24): ₹3.3L → Only ₹2L deductible.

Taxable Impact:

- Deduction used: ₹1.5L (principal) + ₹2L (interest) = ₹3.5L savings.

Scenario 2: One Self-Occupied + One Rented (Old Regime)

Conditions:

- You live in House A & rent out House B.

Tax Benefits:

1. Self-occupied (House A):

- Interest deduction: ₹2L (max).

2. Rented (House B):

- Full interest deduction (no limit).

- 30% standard deduction on rent.

- Loss (if any) can be adjusted against other income (₹2L/year).

Example:

- House A (Self-Occupied): Interest = ₹2.5L → Only ₹2L deductible.

- House B (Rented):

- Rent = ₹4L/year

- Interest = ₹3L/year

- Taxable Rent Calculation:

- Rent: ₹4L

- (-) 30% Standard Deduction: ₹1.2L

- (-) Interest Paid: ₹3L

- Net Loss: ₹4L – ₹1.2L – ₹3L = ₹0.2L (₹20,000 profit)

- No loss here, so no adjustment needed.

Taxable Impact:

- House A: ₹2L (interest)

- House B: ₹0 (since rent > interest)

- Total Savings: ₹2L

Scenario 3: Both Houses Rented Out (Old Regime)

Conditions:

- You rent out both properties.

Tax Benefits:

- Full interest deduction for both.

- 30% standard deduction on rent.

- Loss (if any) can be adjusted (₹2L/year).

Example:

- House A:

- Rent = ₹3L

- Interest = ₹3.5L

- Taxable Rent: ₹3L – 30% (₹0.9L) – ₹3.5L = ₹1.4L loss

- House B:

- Rent = ₹2L

- Interest = ₹2.5L

- Taxable Rent: ₹2L – 30% (₹0.6L) – ₹2.5L = ₹1.1L loss

- Total Loss: ₹1.4L + ₹1.1L = ₹2.5L

- Adjustment:

- ₹2L set off against salary/business income.

- ₹0.5L carried forward for 8 years.

Taxable Impact:

- Immediate Savings: ₹2L (loss adjusted).

Things to note:

1. New Tax Regime (2023-24):

- No deductions for home loans (except limited interest on rented properties).

- Not beneficial if you have home loans.

2. Joint Home Loans?

- If co-borrowers are co-owners, each can claim deductions (₹1.5L principal & ₹2L interest separately).

3. Pre-Construction Interest:

- Deductible in 5 equal installments after construction completes.

Tips to Maximize Tax Savings

✔ If you have 3+ houses:

- Declare 2 as self-occupied (₹2L interest benefit).

- Rent out the rest (full interest deduction).

✔ If rent < interest:

- Use ₹2L loss adjustment against salary income.

✔ New vs. Old Regime?

- If you have home loans, stick to the old regime for maximum benefits.