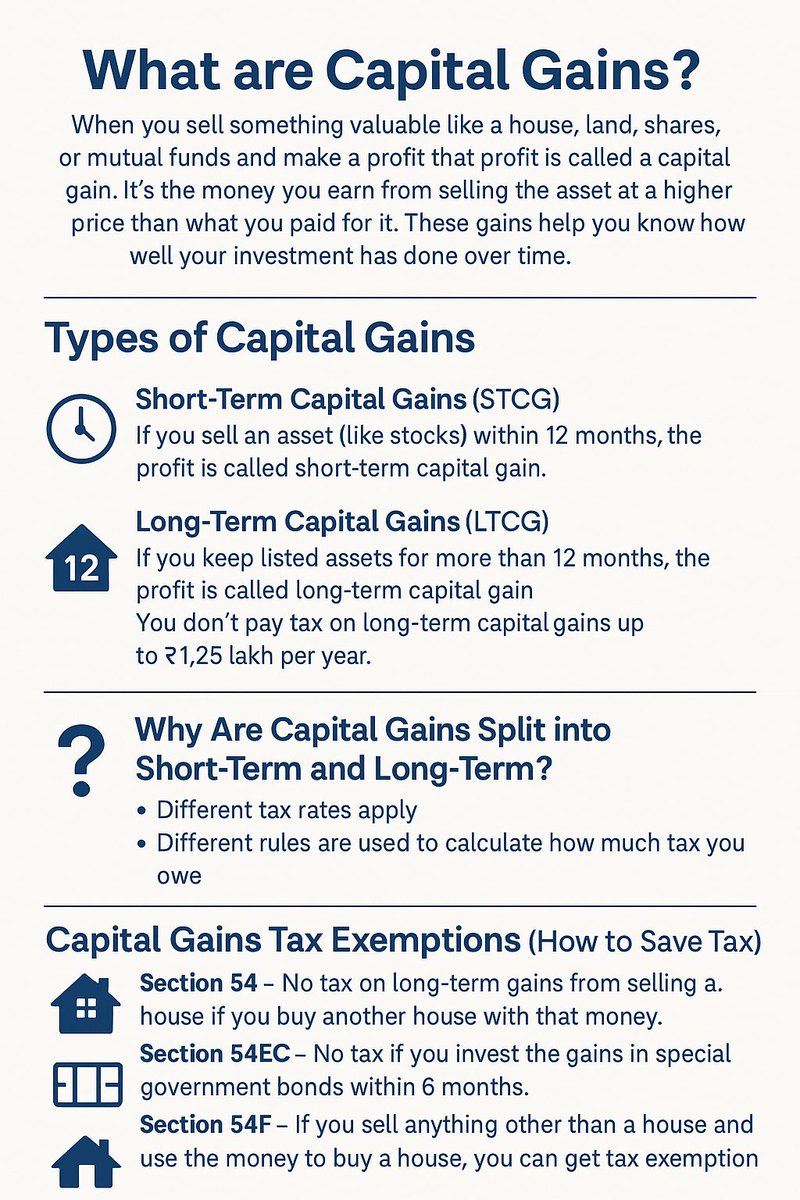

What are Capital Gains?

When you sell something valuable like a house, land, shares, or mutual funds and make a profit, that profit is called a capital gain. It’s the money you earn from selling the asset at a higher price than what you paid for it. These gains help you know how well your investment has done over time.

Types of Capital Gains

There are two types of capital gains:

1. Short-Term Capital Gains (STCG)

- If you sell an asset (such as stocks) within 12 months, the profit is considered a short-term capital gain.

- For stocks and similar investments, the tax rate is 20% (plus a tax known as Securities Transaction Tax or STT).

- For things like property or land, if you sell it within 2 years (24 months), it’s also considered a short-term capital gain.

2. Long-Term Capital Gains (LTCG)

- If you keep listed assets (like stocks or mutual funds) for more than 12 months, the profit is called a long-term capital gain.

- You don’t pay tax on long-term capital gains up to ₹1.25 lakh per year.

- Any gain exceeding ₹1.25 lakh is taxed at 12.5%, and indexation is not applicable in this case.

- For assets like real estate, you must hold them for more than 2 years to be considered long-term.

- For property bought before July 23, 2024, you can choose: 12.5% tax without indexation or 20% tax with indexation, which adjusts the value for inflation.

Why Are Capital Gains Split into Short-Term and Long-Term?

The Income Tax Department treats short-term and long-term gains differently:

- Different tax rates apply.

- Different rules are used to calculate how much tax you owe. That’s why it’s essential to know how long you held the asset before selling.

Capital Gains Tax Exemptions (How to Save Tax)

You can save on capital gains tax using specific rules under the Income Tax Act:

- Section 54 – No tax on long-term gains from selling a house if you buy another home with that money.

- Section 54EC – No tax if you invest the gains in special government bonds within 6 months.

- Section 54F – If you sell anything other than a house and use the money to buy a home, you can get tax exemption.

- Section 54B – Tax exemption when selling agricultural land and reinvesting.

- Section 54D – No tax if the government takes land or building for industrial use.