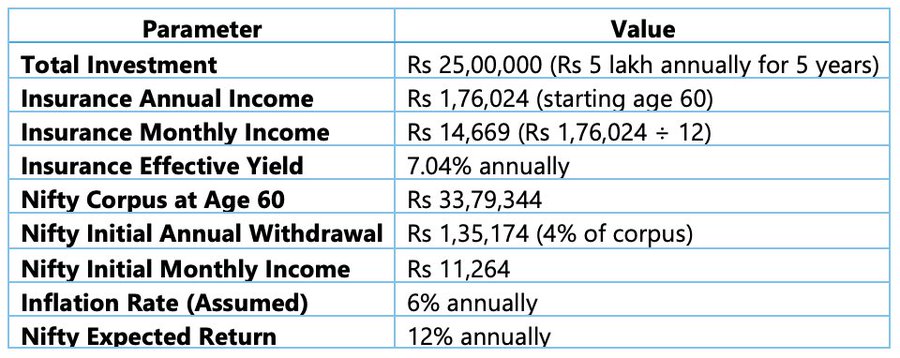

Let’s compare a traditional insurance policy with a Nifty50 index fund.

Key Finding: The Nifty 50 investment becomes superior at age 64, providing significantly higher real income throughout most of retirement. The insurance plan only offers a slight advantage in the first 4 years of retirement.

Investment Parameters

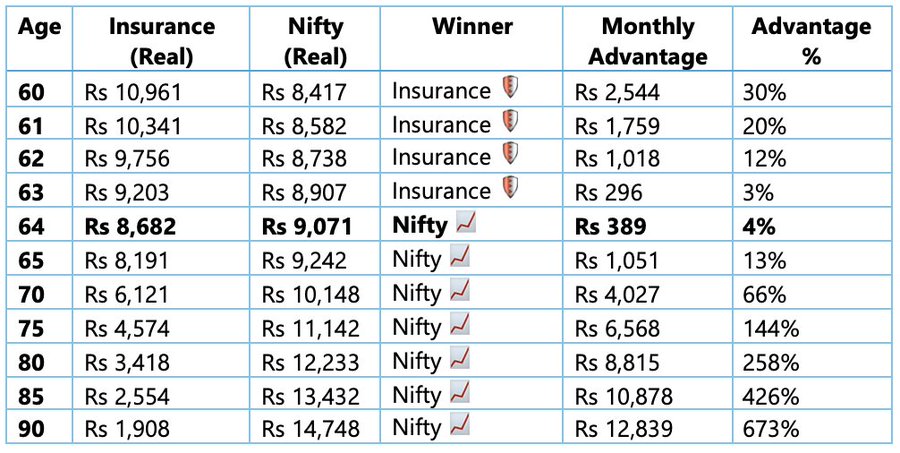

Monthly Income Analysis (Real Values)

*All values adjusted for 6% annual inflation to 2025 purchasing power

🏆 Winner Analysis

Nifty 50 Dominates After Age 64

- Breakeven occurs at age 64 (just 4 years into retirement)

- Provides dramatically higher real income for the majority of retirement

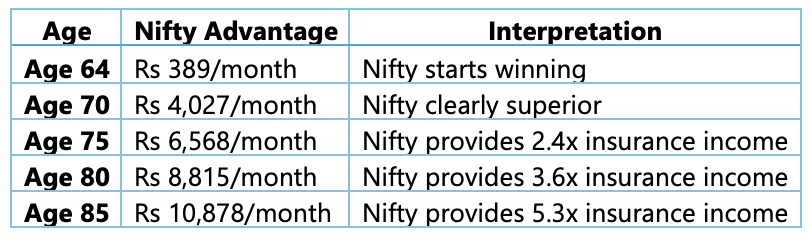

- At age 75, Nifty delivers 144% more real income than insurance

- At age 85, Nifty delivers 426% more real income than insurance

📊 Breakeven Point

Age 64: Nifty 50 starts exceeding insurance income

- Nifty real income: Rs 9,071

- Insurance real income: Rs 8,682

- Nifty corpus at breakeven: Rs 45,97,561

💰 Long-term Wealth Impact

Cumulative Income Analysis (Real Terms)

Investment Recommendation Matrix

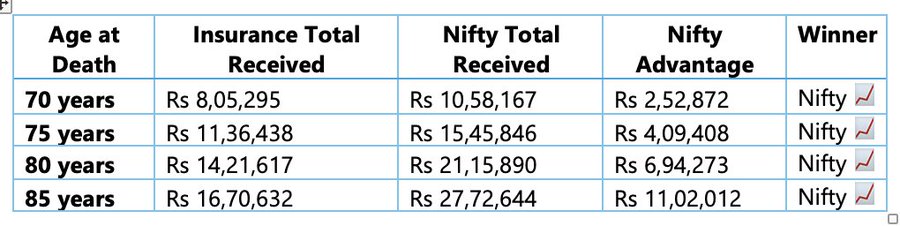

Choose Nifty 50 If:

- ✅ Normal Risk Tolerance – Historical equity returns are well-established

- ✅ Typical Retirement – Planning for 20-30 year retirement (age 60-85)

- ✅ Inflation Protection – Want growing real income over time

- ✅ Wealth Building – Prefer wealth accumulation over guaranteed income

- ✅ Legacy Planning – Want to leave a substantial corpus to heirs

- ✅ Liquidity Needs – May need access to principal for emergencies

Choose Insurance Plan If:

- 🛡️ Extreme Risk Aversion – Cannot tolerate any market volatility

- 🛡️ Very Short Retirement – Expect to live only 60-65 years

- 🛡️ Guaranteed Income Priority – Value certainty over returns

- 🛡️ Simplicity – Want a completely hands-off investment

- 🛡️ Poor Health – Expect below-average lifespan

Critical Analysis: Why Nifty 50 Wins

1. Low Insurance Yield

- 7.04% effective annual return is relatively modest

- Barely keeps pace with inflation expectations

- No growth component to combat long-term inflation

2. Compound Growth Power

- Nifty corpus continues growing even during the withdrawal phase

- Net 8% growth (12% return – 4% withdrawal) compounds powerfully

- Creates an accelerating income gap over time

3. Inflation Protection

- Fixed insurance income loses 50% purchasing power in 12 years

- Growing Nifty withdrawals maintain and increase purchasing power

- Real income gap widens dramatically over time

4. Wealth Preservation

- Insurance plan: Zero wealth remaining after death

- Nifty plan: Substantial corpus remains for heirs (likely Rs 50+ lakhs)

Optimal Strategies

Recommended: Pure Nifty 50 Approach

- Invest full Rs 25 lakhs in the Nifty 50 index fund

- Follow 4% withdrawal rule starting at age 60

- Provides superior income for 96% of the retirement period

- Leaves substantial wealth for heirs

Conservative Hybrid (If Risk-Averse)

- 30% Insurance Plan: Rs 7.5 lakhs → Rs 52,807 annual guaranteed income

- 70% Nifty 50: Rs 17.5 lakhs → Growing income starting at Rs 94,621 annually

- Provides base security plus growth potential

Ultra-Conservative (Only if Extremely Risk-Averse)

- 50% Insurance: Rs 12.5 lakhs → Rs 88,012 annual guaranteed income

- 50% Nifty: Rs 12.5 lakhs → Rs 67,587 initial annual income

- Balanced but sacrifices significant long-term returns

Conclusion

The analysis reveals the Nifty 50 as the clear winner for retirement planning. The insurance plan’s 7.04% annual yield is simply too low to compete with equity market returns over a typical 25-30 year retirement period.

Key Takeaways:

- Breakeven occurs quickly – Just 4 years into retirement

- Income gap widens dramatically – Nifty provides 6x more income by age 85

- Wealth preservation – Nifty leaves a substantial corpus for heirs

- Inflation protection – Growing income vs. fixed income

Bottom Line: Unless you’re extremely risk-averse or expect a very short retirement, the Nifty 50 strategy provides superior outcomes in almost every scenario. The insurance plan’s low yield makes it unsuitable for long-term wealth building and generating retirement income.

Recommendation: Invest the full Rs 25 lakhs in a Nifty 50 index fund and follow the 4% withdrawal rule for optimal retirement outcomes.